Marko Geber/DigitalVision via Getty Images

Marko Geber/DigitalVision via Getty Images

WESCO International’s (NYSE:WCC) growth path would be impeded by the adverse effect of supply chain constraints and one of the utility customers’ shifts from a full revenue model to a service fee model. Free cash flows dried up in FY2021, putting pressure on an already leveraged balance sheet.

Nonetheless, given its reasonably balanced valuation, investors might want to hold the stock with the expectation of modest returns in the short-to-medium term. WCC is set to benefit from its cross-sell initiatives and from the secular growth trends. The current industry environment has facilitated the company’s strategy to focus on building conference room infrastructure, automation, and IoT-related technologies. It has also increased its synergy target from the Anixter business integration.

WCC’s management believes that in 2022, the company will get traction from secular growth in the industry, which will lead to increased investment in grid modernization, rural broadband, and data center development. Along with the industry trend, the company will look to turn the supply chain-related obstacles into business opportunities. WESCO develops digital solutions for data-driven decisions to add to operational efficiencies and provide increased flexibility to its customers. It will cash in on the growth of automation and IoT (Internet of Things) and high-growth technologies, such as 5G and cloud computing.

Earlier in 2022, it launched a new A/V conference room as a service business line to support the growing hybrid work environment. The package solution consists of conference room infrastructure, new applications, predictive maintenance, and advanced automation and analytics.

WCC acquired Anixter in June 2020, as I discussed in my previous article, which has enabled cross-selling synergies through complementary products and services. In 2021, it increased the sales synergies target to $500 million by 2023. However, it increased the target again to $600 million following a larger cross-sell opportunity and faster revenue generation. By the end of 2021, it recorded $365 million in cross-sell synergies. Much of the gains occurred in the EES business, where it expanded its relationship with a multinational integrated energy company.

Looking further into the deal’s $315 million cost synergy opportunity, the company has already realized an estimated $45 million in corporate overhead savings. However, the remaining synergies remain in the supply chain and field operations, which may take a long time to realize.

The inflated backlog level also speaks volumes about the improved revenue visibility. In Q4 2021, its backlog increased by 14% compared to Q3 and even more steeply than a year ago. With increased demand, the company’s sales increased by low teens year-over-year in January, marking a promising start.

Based on the recovery of the energy sector and WCC’s ability to boost the cross-sell program, its management expects FY2022 sales to outgrow industry sales by 200 basis points to 300 basis points, which translates to revenue growth of 5%-8%. It expects to achieve an EBITDA margin of 6.7% to 7%. It recorded an adjusted EBITDA margin of 6.5% in FY2021. It also expects an adjusted EPS of $11-$12 versus $9.98 in FY2021.

However, the company’s efforts will be partially offset by the adverse effect of supply chain constraints and commodity price inflation. On top of that, one of its contracts related to a utility customer would be affected by the customer’s shift from a full revenue model to a service fee model, which would shave sales growth by 0.5 percentage points. Also, the company’s short-term compensation related to a target payout can change its cost structure. A rising transportation and logistics costs can reduce the FY2022 margin by 20 basis points. The depreciation & amortization costs, however, can decrease.

The ISM Manufacturing Prices Index improved in February 2022 compared to the previous month, led by the new order and production growth as the COVID-19 effect subsided. In February, the U.S. unemployment (3.8%) was lower than the 2021-average. The fall in the unemployment rate is a positive for WCC’s near-term growth path.

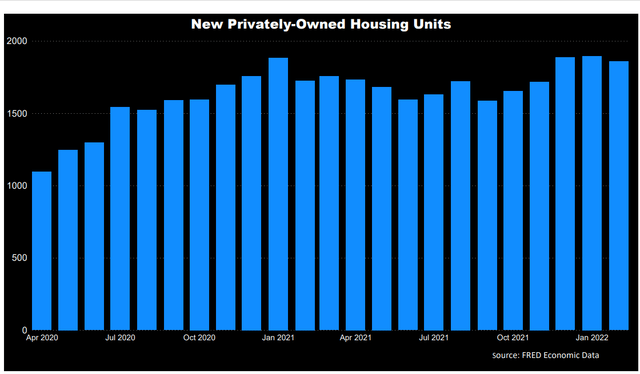

United States Census Bureau

United States Census Bureau

The new privately-owned housing units decreased marginally (by 1.8%) in February 2022 compared to a month ago. It’s still higher than the 2021-average, indicating a possible consolidation in the housing market. According to Edzarenski.com, the pandemic slowed down non-residential construction spending in the past two years and may spill over to 2022 and 2023. Most of the gains in 2021 spending compared to 2020 were due to a substantial boost in residential constructions.

The Electrical & Electronic Solutions segment accounted for 41% of its Q4 2021 sales and was 19.6% higher than the previous year. The continued growth in construction sales and positive momentum in the industrial and OEM businesses resulted in the segment revenue increase. The Communications & Security Solutions (or CSS) segment was up by 10.6% in Q4 (year-over-year) due to added network infrastructure, increased cloud-based applications, and professional audio-visual installations.

The Utility & Broadband Solutions (or UBS) segment accounted for 28% of its Q4 sales. In this segment, sales increased by 23% in Q4 2021 due to storm recovery sales and strong demand for data and high-speed connectivity.

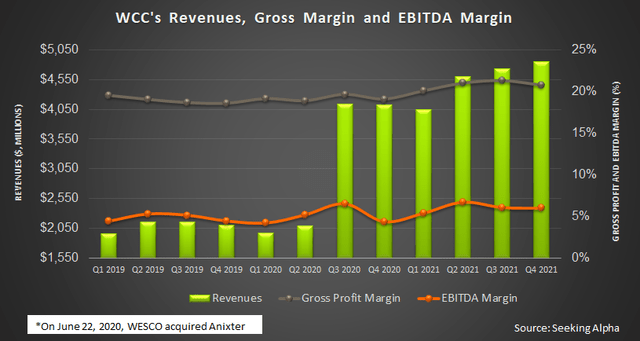

Seeking Alpha

Seeking Alpha

Wesco’s gross profit and EBITDA margins contracted in Q4 compared to Q3. Adverse sales mix in the UBS segment and shipment type mix (higher percentage of lower gross margin direct ship products) led to the gross margin deterioration. Its EBITDA margin also deflated due to write-downs of safety equipment and rising average inventory costs.

In FY2021, WCC’s cash flow from operations (or CFO) dwindled stupendously (88% down) compared to the previous year. Despite a 48% rise in revenues in the past year, its working capital increased following higher purchases of inventory increased other liabilities, and increased accrued payroll and benefits costs. Compared to FY2020, the company’s free cash flow (or FCF) crashed (97% down) in FY2021. Despite that, the management expects all adjusted net income to convert into free cash flow in 2022.

The company’s liquidity totaled $664 million as of December 31, 2021. Its debt-to-equity ratio (1.25x) is significantly higher than its competitors’ (HDS, DXPE, and FAST) average of 0.55x. A dip in free cash flow generation would make improving leverage challenging despite debt retirements.

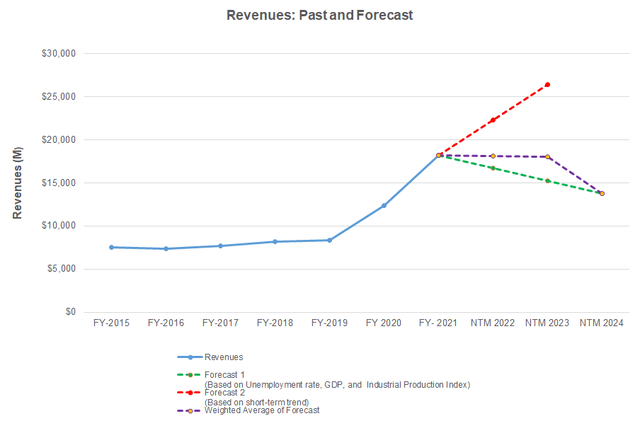

Author created, Seeking Alpha, and FRED Economic Research

Author created, Seeking Alpha, and FRED Economic Research

Based on a regression equation on the industry indicators and WCC’s reported revenues for the past seven years and the previous four-quarters, I expect revenues to remain nearly unchanged in the next two years and decline in the following year.

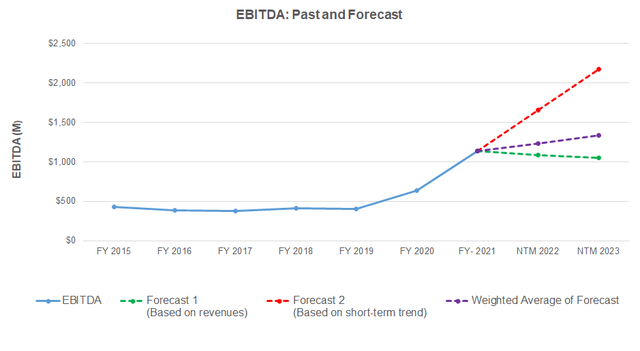

Author created and Seeking Alpha

Author created and Seeking Alpha

Based on the model using the average forecast revenues, I expect its EBITDA to increase in the next couple of years. However, in the next 12-months (or NTM) of 2023, I expect EBITDA to decline.

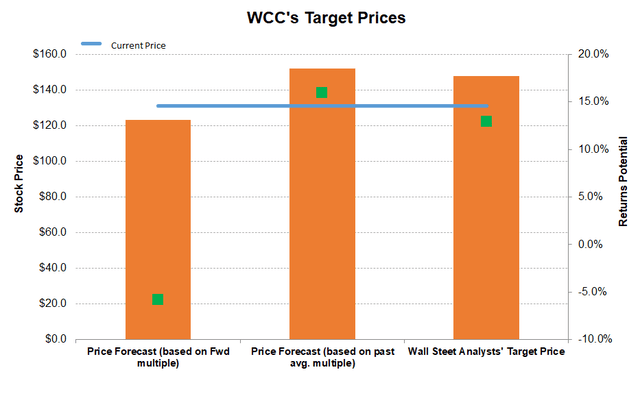

Author created and Seeking Alpha

Author created and Seeking Alpha

The stock’s returns potential using the price forecast based on the forward multiple (8.9x) is lower (6% downside) than returns potential using the past average multiple (16% upside). Wall Street analysts estimates suggest a modest 13% upside.

WCC’s forward EV-to-EBITDA multiple compression versus the current EV/EBITDA is less steep than peers, typically resulting in a lower EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple (10.3x) is lower than its peers’ (MSM, DXPE, and FAST) average of 18.5x. So, it is reasonably valued compared to its peers.

Seeking Alpha

Seeking Alpha

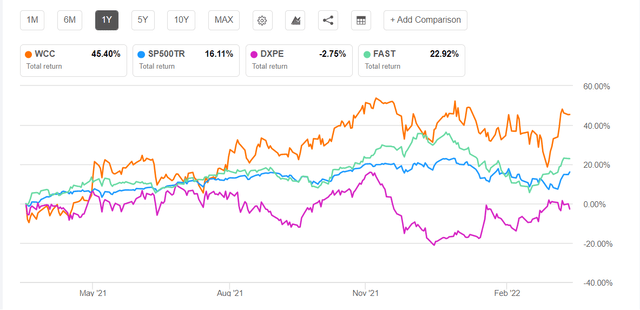

WCC is set to benefit from its cross-sell initiatives following the Anixter acquisition. The EES business has recently expanded its relationship with a multinational integrated energy company. In its most recent endeavors, it plans to focus on high-growth technologies. A higher backlog by the end of 2021 also speaks volumes about the improved revenue visibility. So, its stock price outperformed the SPDR S&P 500 Trust ETF (SPY) in the past year.

However, I see short-term concerns over the operating margin triggered by the supply chain constraints and commodity price inflation. Cash flows also weakened severely in FY2021, which can be concerning given an overly leveraged balance sheet. Nonetheless, I think the positive factors can outweigh the negatives, and the stock has some room for a modest price hike in the short-to-medium term.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author Profile

Latest entries

राशीफल2024.04.18आज का राशिफल 18 अप्रैल 2024: मेष, कर्क और वृश्चिक राशि के जातकों को धन लाभ के योग हैं, जानिए बाकी राशियों का कैसा रहेगा दिन – GNTTV

राशीफल2024.04.18आज का राशिफल 18 अप्रैल 2024: मेष, कर्क और वृश्चिक राशि के जातकों को धन लाभ के योग हैं, जानिए बाकी राशियों का कैसा रहेगा दिन – GNTTV लाइफस्टाइल2024.04.18मेरी क्रिसमस फिल्म ताज़ा खबरे हिन्दी में – मेरी क्रिसमस फिल्म ब्रेकिंग न्यूज़ हिंदी में – Hindustan

लाइफस्टाइल2024.04.18मेरी क्रिसमस फिल्म ताज़ा खबरे हिन्दी में – मेरी क्रिसमस फिल्म ब्रेकिंग न्यूज़ हिंदी में – Hindustan धर्म2024.04.18सुधा मूर्ति द्वारा लिखित "द सेज विद टू हॉर्न्स: अन्यूश़वल टेल्स फ्रॉम माइथोलॉजी" | – Current Affairs Adda247 in Hindi

धर्म2024.04.18सुधा मूर्ति द्वारा लिखित "द सेज विद टू हॉर्न्स: अन्यूश़वल टेल्स फ्रॉम माइथोलॉजी" | – Current Affairs Adda247 in Hindi टेक2024.04.17'This billionaire tech startup' saw the biggest fall in valuation globally in 2024 – The Times of India

टेक2024.04.17'This billionaire tech startup' saw the biggest fall in valuation globally in 2024 – The Times of India